Digital Payments Landscape for 2022

As 2022 gains steam, it’s amazing to look back and see how much the digital payments landscape has changed – and to look ahead and see what the future holds.

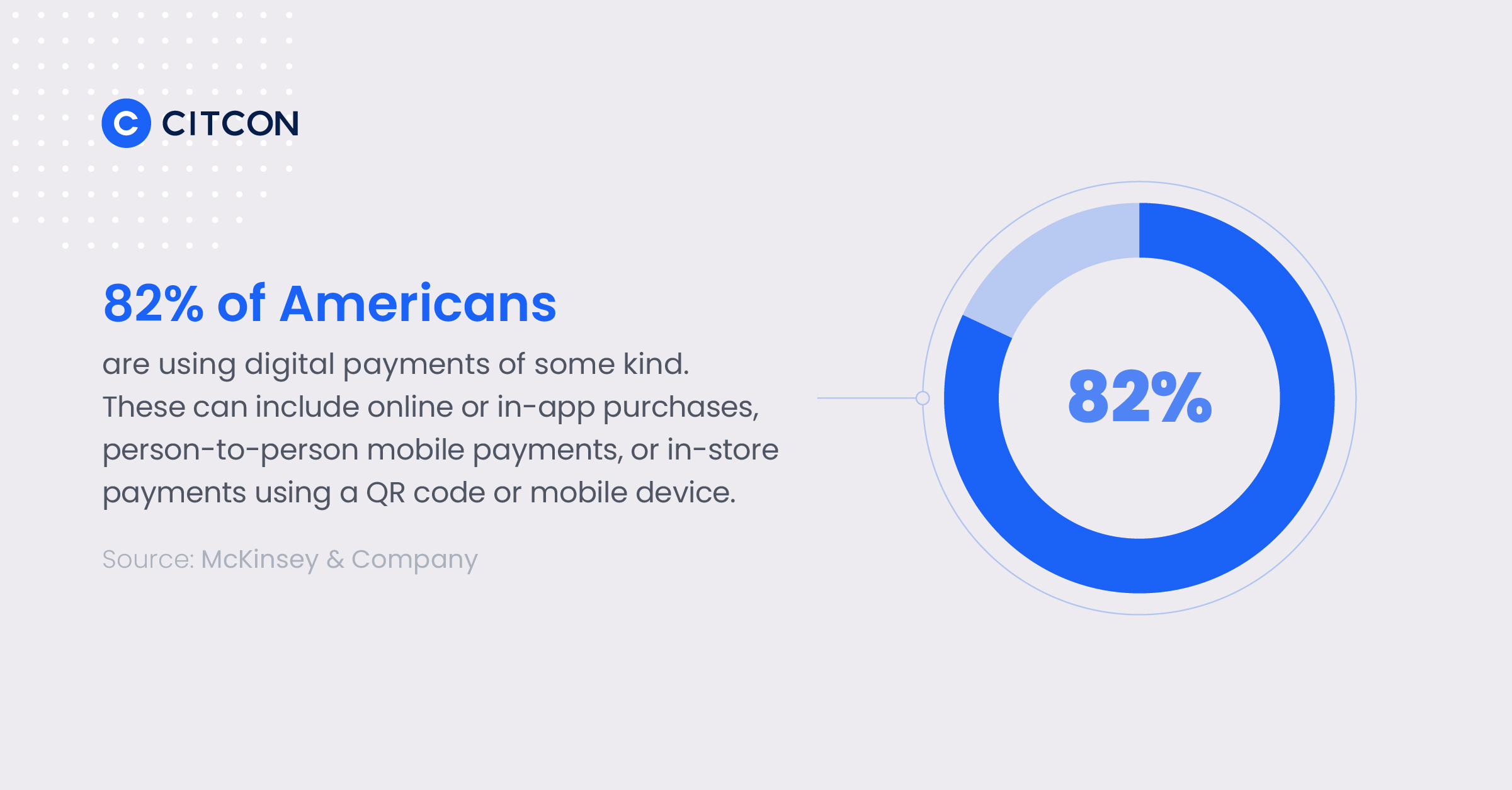

According to McKinsey’s 2021 Digital Payments Consumer Survey, 82 percent of Americans are using digital payments of some kind. These can include online or in-app purchases, person-to-person mobile payments, or in-store payments using a QR code or mobile device.

While consumers of all age groups use digital payments, usage is highest among 18-34 year olds who have the most trust in digital payment services. In fact, according to the same McKinsey survey, in-app purchase adoption rates are three times higher amongst the 18-34 bracket than those age 55 and older.

As consumer interest in (and adoption of) digital payments continues to grow in key demographic segments, businesses are forced to consider ways to help make their payment processes faster, safer, and more convenient than ever before.

Let’s take a look at what to expect from the digital payments industry in 2022.

6 Digital Payment Trends to Watch in 2022

1. The COVID-19 Effect

Though a shift was already taking place, the COVID-19 pandemic forced a quicker transition to more varied digital payment options. The shift seems to be continuing to grow even as consumers go back to their regular lives. More Americans are using some form of digital payments than ever before. However, we’ve seen some shifts in trends as a result of the pandemic.

For example, while use of in-app payments continues to be a popular form of digital payments in 2022, the types of purchases made with them have changed a bit in recent years. Prior to 2020, consumers were using ride-share services much more frequently. While these numbers have since declined, other in-app purchase types increased – such as food delivery service. We are likely to see these spending trends even out again as time goes on.

2. Buy Now, Pay Later

Who doesn’t love the idea of buying something without the need to immediately pay for the item in full? According to McKinsey survey respondents, 30 percent reported that they made a purchase using a buy now, pay later service in the past year. The use of buy now, payment later has grown by 3 percent since 2020, signifying that this digital payment method is gaining popularity. In fact, according to an Insider Intelligence report, this industry will continue to grow to an expected $680 billion in transactions by 2025.

Not only does this digital payment method give consumers the option to try a product without paying the entire price in one payment, it also allows them to buy higher priced items and spread out the payments over time. Consumers have reported they’ve purchased items they may not have considered if they weren’t provided this alternative payment method.

3. Contactless Payments

Contactless payments have risen in popularity over the past two years. Use of this digital payment method allows the consumer to tap or wave their card in front of the card reader rather than insert it into a machine or hand it to an employee. Not only does this limit contact, but it’s also faster and more convenient for customers when making a purchase. Customers can go into a store, pick out their items, pay for and bag them, all without having to retrieve cash or a card at the point of sale.

Visa recently announced that its contactless, tap-to-pay transactions grew by 30 percent since the previous year. The same study stated that 48 percent of those surveyed would not shop at a business that didn’t offer a contactless method of payment. Armed with this information, businesses should know that if they don’t accept contactless payments, their sales might fall behind the curve.

Companies such as Apple, Google, and Samsung have set up contactless payments systems through their apps. Consumers download the app and scan or manually enter their credit card information into their digital wallet. They can then use the app to wave across a payment reader. These contactless payments, also sometimes referred to NFC payments, are made through use of NFC (near-field) communication technology.

4. Cryptocurrency

While cryptocurrency is currently rarely used in retail transactions, it can be used for secure online payments that are not handled by any third parties. Built on the blockchain, cryptocurrency is one of the most secure forms of payment because it uses cryptography to safeguard transactions.

Bitcoin is the most well-known form of cryptocurrency. Uses for this form of decentralized and encrypted payment mostly include fund transfers and trading investments.

According to the aforementioned McKinsey survey, one out of five reported possession of cryptocurrency, which is a 6 percent jump from 2020. And those who don’t own it stated that they don’t fully understand it yet. As this evolves and more consumers have a form of cryptocurrency, we might see it used for more basic types of transactions.

5. Mobile Point of Sale

Businesses will continue to take advantage of mobile points of sale, which allows them to take their businesses anywhere, because they don’t need to rely on a brick and mortar store to accept payments. This means business owners can travel to concerts, festivals, trade shows, or any other locations where there might be demand for their products.

Using mobile point of sale technology also allows businesses to accept payments from different areas within their stores, rather than have customers wait in line in a centralized checkout area. One example of this is at Apple stores, where customers are able to scan the barcode or a QR code of the item they’d like to purchase with the camera on their iPhone, then complete checkout using their Apple app.

6. Mobile Wallets

Why carry a real wallet when you can leave home with a mobile version? A mobile wallet allows consumers to use an app that works just the same as a physical one, letting them send, receive, and store money. They can pay bills, make purchases, and earn rewards, just as they would otherwise. However, because many mobile wallets use dynamic QR codes, consumers enjoy greater security than physical wallets containing skimmable credit and debit cards.

>> For a look at recent QR code payment developments, including how QR code-based payments and other solutions have gained steam around the world, checkout this QR Code Payment Tracker, created in partnership with PYMNTS.com.

Of the mobile wallet users surveyed by McKinsey, 15 percent said they regularly leave home without their physical wallet. In addition, 11 percent said they will leave their physical wallet at home if they aren’t planning a purchase or know that a digital wallet is accepted where they’re going.

Of the mobile wallet users surveyed by McKinsey, 15 percent said they regularly leave home without their physical wallet. In addition, 11 percent said they will leave their physical wallet at home if they aren’t planning a purchase or know that a digital wallet is accepted where they’re going.

Examples of mobile wallets include ApplePay, Google Pay, Venmo, and PayPal. It’s not uncommon for consumers to use multiple mobile wallets. According to Forbes, 32 percent of those who use mobile wallets have three or more mobile wallets on their smartphones.

Digital Payments in 2022: How to Meet the Trends

As you can see by the latest trends in the digital payments landscape, these quick and convenient payment options are increasing in popularity and helping to boost incremental spending based on their heightened convenience and security.

Is your business equipped to handle the demand for digital payments in 2022? If not, Citcon can help you meet the evolving landscape for accepting payments. Connect with a payments professional today to find out how.