5 Best Ways to Receive International Payments

By Jamie Elgie

It’s exciting to be a growing business. The possibilities seem limitless, and as that growth continues to progress, it feels like anything can happen. However, rapid growth can be difficult to sustain, especially without proper guidance and a thoughtful approach to expansion.

When it comes to international expansion, accepting the right payment methods — and accepting them in a cost-effective manner — is vital for any business. An international payment is one that crosses national borders and involves at least two currencies. This scenario arises when your operation is in one country, and you expand your sales into a second country.

One important caveat to note is that, when receiving money from a foreign country, the funds are usually converted into the preferred currency of the country in which your operation resides. This can result in costly currency exchange rates or fees incurred by your business.

Many companies err by expanding into a market they don’t fully understand. This can result in lost sales due to everything from off-target messaging to a lack of customer payment options. Conducting market research is important, and it requires far more than just seeing if there is demand for your product in the area. You’ll also need to determine how people shop, where they shop, and how they like to pay.

From there, you will need to decide on a payment platform that works for your company, is affordable, provides good merchant support, and supports the preferred payment methods of your target customers. Accepting money from foreign clients with no hiccups or extra fees is paramount to earning and keeping loyal customers as well as to keeping your business profitable, but doing so isn’t always easy.

Related Read: Factors to Consider When Entering a New Market

How to Get Money From Foreign Clients

Security and simplicity are both key when it comes to making and accepting international payments. You want your customers to be able to easily choose an option that works for them, and not worry about whether their information may be stolen. This benefits both parties, as your foreign clients will appreciate a frictionless payment experience and you will realize better sales as a result. Plus, a security breach is a surefire way for your business to garner negative press attention.

There are many ways to accept payments in a new market, but some are better than others. Also, different methods may pair well with specific businesses, but not be as great of a fit for others. There are five common methods for accepting international payments, and each has its benefits and drawbacks. Ultimately, you have to decide what will work best for your customers’ wants and your business’ needs.

How to Accept International Payments: The 5 Best Ways

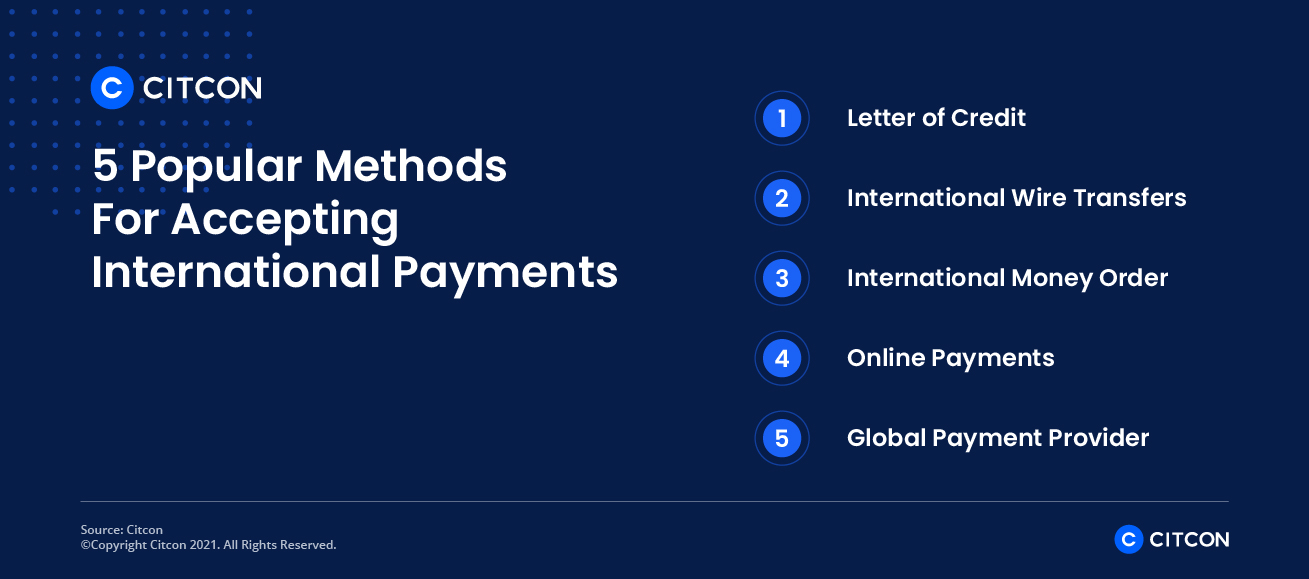

The five most popular and proven methods for accepting international payments are:

1. Letter of credit: This is a low-risk and easy way to take international payments while expanding into a foreign market. All you need to start is a letter of credit sent from your existing bank to another bank in your new location. The letter will state that your payments are guaranteed by your primary banking institution. The bank bears the responsibility of insuring the payments (though they are your funds, it’s good to know your bank is behind you in case of emergency). The process is also very secure, but tends to be very costly. There can be large transaction fees for each purchase. Also, unlike some of the other forms of payment below, a letter of credit can expire, leaving you without payment if a transaction is not completed on time.

2. International wire transfers: Wire transfers are fast, and the funds are typically available almost instantaneously. They’re also quite secure, making them a safe choice for many businesses. While all this is great, there are drawbacks to using wire transfers. International wire transfers are hard to trace, so if there is ever a dispute over payment, it may be difficult to sort out. Additionally, international wire transfers are one of the pricier payment methods out there, with some banks charging up to $60 per transaction.

3. International money order: This time-tested methodology has been around since 1864. Sending a money order is similar to a wire transfer, but the money is paid up front by the customer in cash or credit. This is beneficial because money orders are inexpensive, and you also know your customers’ funds are guaranteed when accepting money orders as payments. However, money orders do take a long time to process, and they aren’t a terribly secure payment method. They’re hard to trace and authenticate, which leads to them being used in scams. The savings may not be worth the risk if you are concerned about this, or if you have a very large customer base.

4. Online payments: You can partner with a service provider, and they will provide access to many different types of payment options so you can easily accept a variety right away. This type of payment system is generally quick and easy to implement, and you will be able to process payments right away. For an expanding business, this can be a huge benefit. Payments are also processed quickly and securely. However, you will want to choose a provider with transaction fees you can afford, as the small percentage charged for each purchase can really add up and cut into potential profits. Also, you will want to ensure the provider you choose supports the payment methods that are preferred by your target customers. Not every provider has payment options available in every country, so you will want to choose the one that grants you the right access.

Related Read: 10 Questions to Ask a Global Payment Gateway Provider

5. Global payment provider: A global payment provider can help you immediately have access to many different payment options, often for both online and in-person transactions. Many international customers prefer to use alternatives to cash or credit. For example, more than 90% of people in China’s largest cities use WeChat Pay and Alipay as their primary payment methods. A global payment provider like Citcon can allow them to do so securely and easily.

Before signing any agreement, be sure to ask the global payment provider if they are able to localize digital payments in the regions where you want to sell while still offering competitive processing rates.

Related Read: Guide to Cross-Border eCommerce in China

Receiving Money From a Foreign Country: What to Know

Even within the main five methods for accepting international payments, there are many options to explore and decisions to make. You can choose from a variety of banks for lines of credit, for example, or go with a variety of services for international wire transfers.

When selecting a payment provider, make sure you consider the following key elements:

• Terms: You’ll want to make sure the terms are agreeable for your business before signing any agreement. Keep in mind that you may grow or decrease in size, so be sure the terms can accommodate any changes without impacting your bottom line. Consult experts if need be, so you can be sure your deal is the best possible.

• Business needs: Only you can decide what option will work best for your business and customers. Conduct research to find out what customers prefer within your target region, if you are unsure. You should also be aware of how fast you may grow. You don’t want to expand internationally only to flop because of unhappy customers experiencing friction during the payment process.

• Timing: Consider not just the timing of when you launch your payment options, but the marketplace as well. For example, a retailer expanding during the Christmas season into a predominantly Christian country may result in a boom of sales initially, but once the gifting season ends, sales could slow down. Be ready for the differences in any market’s ebb and flow, as every market is unique.

Preparing to enter a new market in a new country can be daunting. A global payment provider can help pave the way, and make it easy for you to start doing business across borders right away. To explore Citcon as your potential global payment provider, request a brief, no-obligation demo today.