3 Undeniable Global Stats About Mobile Wallets

The way we interact with money is changing. For some, money is still a jingle of coins and crumpled bills in their pocket — but for millions of others, money is an electronic currency, accessed by a digital screen.

Any way you look at it — whether digital or traditional — availability and accessibility is the key to purchasing. And mobile payments are at the forefront of a changing world of commerce transactions.

Mobile Wallet Usage Statistics You Can’t Deny

In-store contactless mobile payments made through smart devices, digital wallets and QR codes are on the rise throughout the world, with growth continuing to increase as more customers become familiar with their use. The three undeniable statistics below showcase the disruptive nature of mobile payments and explain why contactless payments are here to stay.

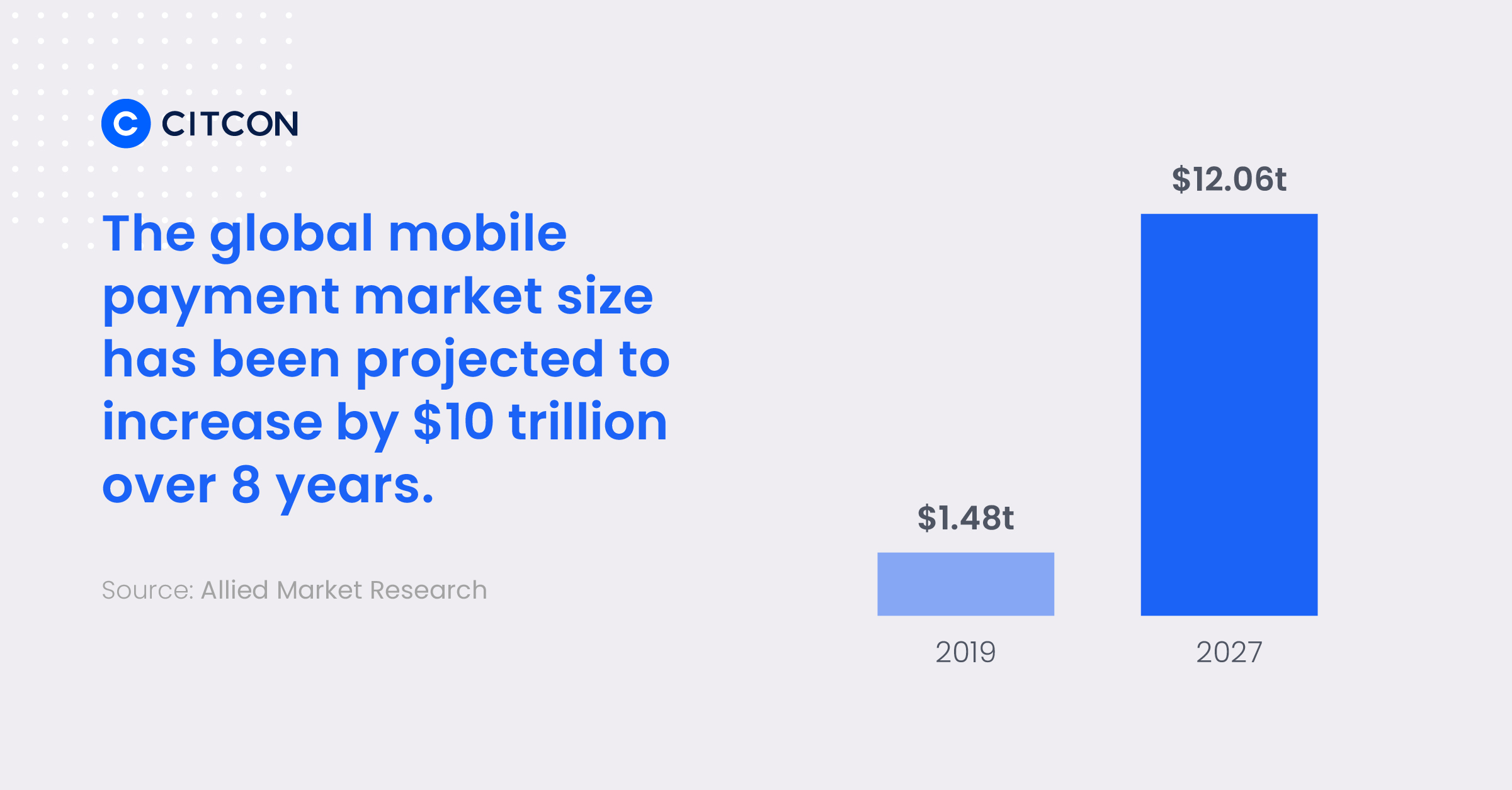

1. The mobile payment market is projected to reach $12.06 trillion by 2027

The current use of digital payment platforms – such as Apple Pay, PayPal, Venmo, AliPay, and WeChat Pay – is already significant. In 2021 PayPal had 392 million active users and Apple Pay 507 million. In China, the number of active users is even larger. WeChat had a staggering 1.151 billion users and AliPay more than 1.2 billion. According to a report by Allied Market Research, the global mobile payment market size is projected to reach $12.06 trillion by 2027, growing at a CAGR of 30.1% from 2020 to 2027.

The rise of gen z as consumers (those under 40, also known as digital natives) is also expected to contribute to the growth of mobile pay. In 2026, digital natives are expected to comprise 59% of all consumers in the U.S. market. Other drivers for the increased use of mobile wallet payments include convenience, security and speed.

While some consumers have been wary of the security of mobile payments, that sentiment is changing for the positive. Consumers are finding that mobile wallets offer highly-advanced protection methods including encryption and tokenization to secure their credit or debit card information. Now, consumers are starting to view cashless payments as more secure than carrying physical cards. This shift in consumer perception is also pushing mobile wallet usage forward.

2. Use of cash for POS transactions is decreasing, while the use of mobile wallets at POS has increased by 19.5%

Cash POS transactions fell globally in 2020 and have continued to drop. According to the 2021 Global Payments Report, in 2020 cash was used for only 20.5% of POS transactions (a 32.1% reduction from 2019). In some countries the percentage of POS cash transactions was even lower — 5.4% in Canada and 4.5% in Norway. The report suggests that POS cash transactions will decrease globally to only 12.7% by 2024. The use of mobile wallets has made up for most of this loss. According to Juniper Research, the number of people using mobile wallets is expected to reach 4.4 billion by 2025.

This prediction makes sense, as mobile payments have become the preferred payment method among both millennial and generation z consumers due to their convenience and integration with loyalty programs.

Some governments are passing laws that are accelerating the adoption of cashless payments. Both Japan and Singapore have national mandates that make it easier for payment providers other than banks to do business. An amendment to Japan’s Payment Services Act (PSA) took effect in May 2021 that removed a numerical transfer cap on fund transfer services by nonbank institutions. This makes it easier for more types of businesses to get into mobile payments.

In September 2018, the Singapore government launched a standardized QR code infrastructure SGQR, which has led to increased usage of QR code payments. SGQR can be found at more than 160,000 merchant acceptance points. As more countries adopt policies that make it easier to enable mobile payments, usage rates will naturally follow suit.

3. Use of mobile payments is expected to continue to grow both for POS and ecommerce payments

Lack of cash or credit cards is no longer an obstacle to purchases. Diverse organizations have adopted mobile payments including the Girl Scouts, which have more than 3,800 troops selling cookies in this way. According to the 2021 Global Payments Report, global digital and mobile wallet usage statistics are expected to increase and reach 33.4% of POS payments by 2024, followed by credit cards (22.8%), debit cards (22.4%) and cash (12.7%). A similar trend is expected in ecommerce, with digital and mobile wallet payments comprising 51.7% of ecommerce payments by 2024, followed by credit cards (20.8%), and debit cards (12.0%)

Another trend worth following is buy now, pay later (BNPL) payments. BNPL is an alternative payment method that allows consumers to pay in installments over time. BNPL provides the ability to make a purchase without having to pay all at once, which makes it a popular cashless payment option for those with less access to credit or cash savings.

While use of mobile payments as a whole (globally) are expected to grow, there are some interesting variabilities in trends by region:

Asia-Pacific

The Asia-Pacific region is far ahead of the pack. Even before the pandemic digital/mobile wallet payments had grown in popularity. Digital/mobile wallet payments in 2020 accounted for 40.2% of POS payment methods. This number is expected to increase to 47.9% by 2024.

Middle East and Africa

In this region the use of cash is still prevalent, but is slowly declining. In 2020, a total of 52.6% of payments at POS were made with cash. This number is expected to decrease to 51.7% by 2024. However, digital/mobile wallet payments at POS are expected to double from 8.3% in 2020 to 16.8% in 2024.

North America

Credit cards were the primary method of payment at POS in North America (38.6%) and are expected to continue to decrease slightly but still take the lead in 2024 (38.4%). However, digital/mobile wallet payments at POS are expected to increase from 9.6% in 2020 to 15.5% in 2024.

Latin America

In Latin America credit cards are also favored as the most popular form of payment at POS. Both the use of cash and credit cards are expected to decrease in the next four years. In contrast, digital/mobile payments are expected to grow significantly from 19.8% in 2020 to 31.2% in 2024.

Learn More about Mobile Payments

Top digital wallets accepted in the U.S.

How mobile payment systems work