Worldwide Payments for eCommerce: 3 Steps for International Expansion

Today’s consumers are doing more online shopping than ever — in North America and abroad. However, before expanding internationally to capture their share of the wave of online sales, merchants must explore the acceptance of global payments for eCommerce.

This article examines the payment trends impacting international eCommerce expansion and explains how online merchants can seamlessly transition into a global market.

International eCommerce Payments

Government lockdowns and brick-and-mortar store closures have increased consumer adoption of online, mobile and social shopping in recent years. Experts estimate the pandemic accelerated the shift to eCommerce by five years.

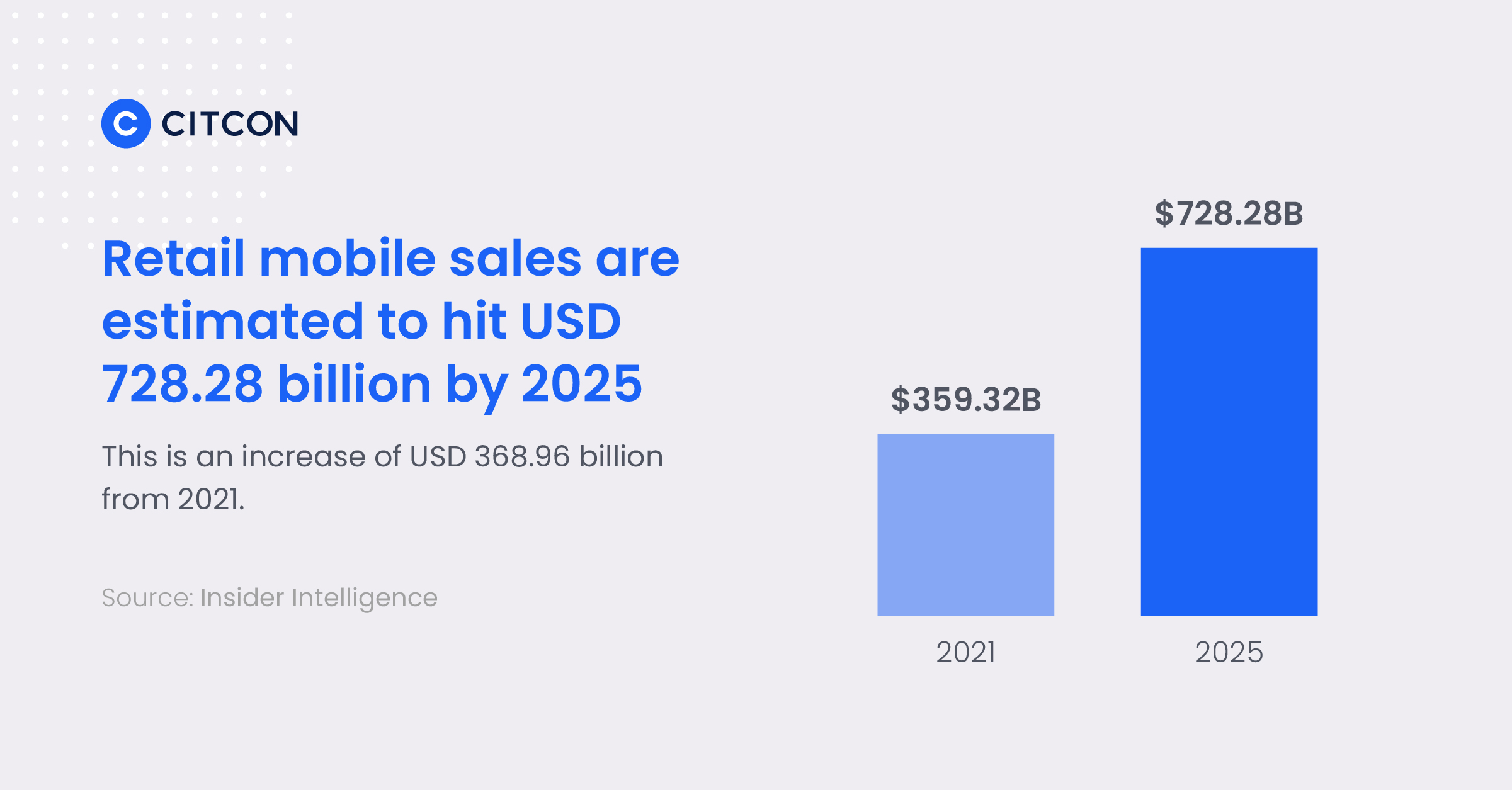

If sales are any indication, it’s safe to say retail mobile shopping won’t be slowing down any time soon. In 2021, retail mobile sales reached USD 359.32 billion, and by 2025, retail mobile sales are estimated to hit USD 728.28 billion.

Turning social channels into shoppable storefronts is another way merchants are cashing in on the digital boom. According to research by Sprout Social, more than 33% of consumers use social media to research products, services and brands. Twenty-five percent also use social media to purchase products.

When it comes to payments, increases in online, mobile and social shopping are driving growth in digital wallet use. The correlation seems obvious when you consider the following scenario presented by:

Without a digital wallet, it requires three hands to make a purchase: one to hold the phone, one to hold your credit card, and a third to type in your information. “Three-handed social commerce shoppers” is a pretty narrow demographic.

In addition to digital wallets, buy now, pay later (BNPL) payment schemes are gaining ground with consumers. According to JP Morgan, “Mobile, cross-border and buy now, pay later are on the rise as consumers show a willingness to adopt new shopping and payment methods.”

The Swedish buy now, pay later company Klarna reported an in-platform transaction spike in the first quarter of 2021. Klarna’s gross merchandise volume (GMV) — the value of transactions made using its payment platform — nearly doubled from USD 9.9 billion in 2020 to USD 18.9 billion in 2021.

One thing is certain: the eCommerce landscape is evolving. Consumers are using more digital channels to shop for goods and services, while increasingly leveraging digital wallets and alternative payment methods like BNPL to pay for their purchases.

eCommerce merchants planning to expand globally must keep these payment trends in mind.

eCommerce Global Payment Processing: How It Works

To process eCommerce payments internationally, a global payment gateway captures customer payment data, authorizes the transaction and delivers the funds to the merchant. The payment gateway also informs the merchant whether the payment is accepted or declined. In the case of acceptance, the transaction is finalized. The issuing bank transfers the funds to the acquiring bank, so the merchant receives payment.

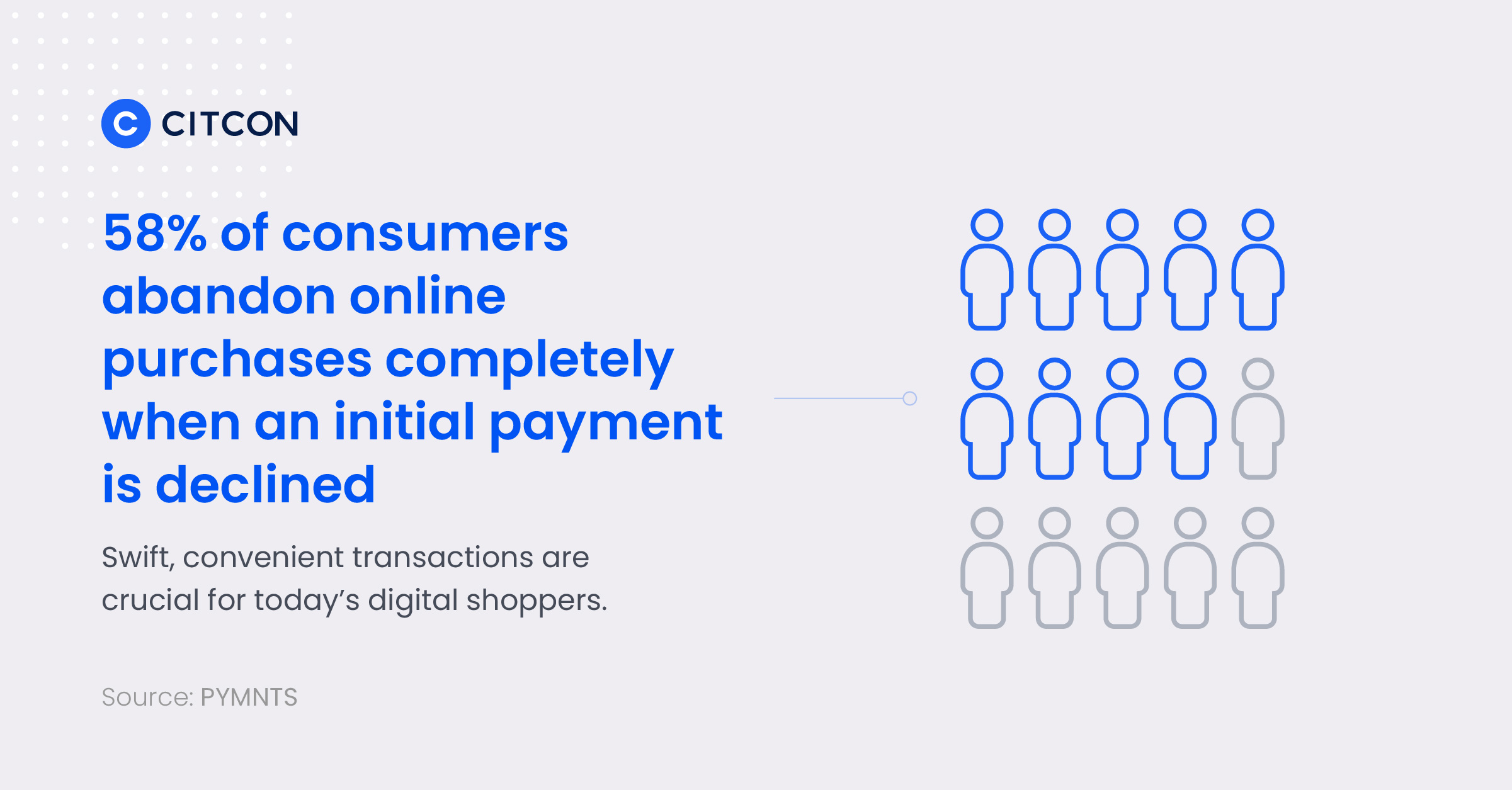

The right global payment gateway can help merchants transition smoothly into new markets and overcome common payment challenges associated with conducting international eCommerce business. Top concerns for online merchants selling abroad include fraud, data security, transaction approvals, and shopping car abandonment. Not all payment gateways can properly handle cross-border payments, leading to an increase in false declines. False declines, or valid transactions that are wrongly rejected, lead to lost revenue and poor customer experiences.

According to research by PYMNTS.com, up to 58% of consumers abandon online purchases completely when payments are declined. Swift, convenient transactions are crucial for today’s digital shoppers.

Accepting Payments Internationally: What to Consider for eCommerce

When creating an international eCommerce expansion plan, a merchant must make several important decisions — starting with geography.

Geographic Regions

Asia Pacific

One of the hottest eCommerce markets is the Asia-Pacific (APAC) region. Countries that fall within APAC include Japan, South Korea, Australia, New Zealand and China — the largest eCommerce market in the world. According to the World Economic Forum, here are a few reasons why APAC should be on merchants’ eCommerce expansion radars:

• Sixty-five percent of the world’s eCommerce sales come from APAC

• APAC is three times the size of the North American market, with a 50% projected growth rate from 2020 to 2025

• Five-year APAC eCommerce incremental sales equal USD 870 billion

• Total eCommerce sales in China alone grew to USD 1.973 trillion in 2019

United Kingdom

Despite being a smaller region, the United Kingdom (UK) is the most advanced eCommerce market in Europe, with eCommerce sales forecasted to reach more than USD 119 billion by 2025. Revenues continue to grow by double digits as online shoppers embrace mobile shopping.

Germany

Germany may not be top-of-mind when merchants think of global eCommerce expansion, but it should be. Following Brexit, Germany became a significant eCommerce market with annual online sales estimated at almost USD 85 billion.

France

French eCommerce ranks seventh globally, with revenue expected to grow to over USD 72 billion by 2025.

With a population of 64.53 million, the French eCommerce market is attractive to NAMs due to its:

• High internet penetration of 84%

• Large online shopping population of 80%

• Growing mobile adoption with an estimated growth of four million users from 2018-2024

France is a well-established market offering lucrative opportunities for international online merchants.

Customer Preferences

Payment preferences are another important consideration for eCommerce merchants looking to expand their business across borders. Preferences vary by country, so merchants hoping to succeed in international eCommerce should offer locally preferred payment methods.

According to a global survey by UPS, one out of five online shoppers abandoned their carts at checkout due to the store not offering their preferred payment methods. Partnering with a global payment gateway to localize payments can help merchants lower cart abandonment rates and even attract more customers.

Security, Compliance and Fraud

Fraud and data theft are also key concerns for international eCommerce merchants. In an April 2021 PYMNTS.com report, 56% of companies said payment fraud was the top worry in cross-border transactions.

Other critical points of consideration for merchants expanding internationally are security and compliance. Choosing a secure and compliant global payment gateway can help merchants meet the 12 requirements established by the Payment Card Industry Data Security Standards (PCI DSS), the 78 base requirements and 400 test procedures — and the European Union’s Payment Services Directive 2 (PSD2).

Payment tokenization adds another layer of protection for international transactions. Tokens are strings of random characters that replace sensitive information, such as credit card numbers. Tokens are used during digital wallet payment transactions, to prevent sensitive information from being transmitted during the payment process.

The right payment gateway can also help lower chargeback rates. By offering local payment options to international customers, merchants can decrease chargebacks and the likelihood of fraud. The proof is in the data: local credit authorizations average 90% vs. 50% from cross-border transactions.

Fees and Costs

When looking for a global payment gateway partner, it’s important to consider processing fees. Merchants partnered with Citcon, for example, pay up to 40% less when accepting Alipay and WeChat Pay digital wallet payments versus international credit card payments.

In addition, watch out for high cross-border fees — assessments charged to a merchant when a customer pays with a credit card issued by an international bank. These fees, also referred to as “international service assessments” or “foreign transaction fees,” differ from currency exchange fees, which are often billed separately.

An ideal scenario is to partner with a global payment gateway provider that doesn’t charge extra fees on top of the domestic merchant discount rate (MDR) for digital wallet transactions, and that guarantees payments for digital wallets so fraud and chargeback liability are significantly reduced.

Merchants must also account for setup fees charged by payment gateways. Costs vary by provider, with some gateways waiving setup fees entirely. Setup fees aren’t always publicly available, so speak directly with a provider’s sales team to get the details.

Disbursements

Merchants needing to send out commission payouts — be it to freelancers, direct sellers, influencers, or marketplace sellers — need to partner with a payment gateway provider with strong cross-border payout capabilities. This is because cross-border payouts have higher failure rates due to ever-changing regulations. Workaround methods exist but often incur high fees or result in payments being disbursed in the sender’s currency, requiring funding via prepaid cards.

The right global payment gateway partner enables hassle-free payouts so merchants can efficiently disburse funds in local currencies using local payment methods, typically via a direct deposit into the recipient’s bank account.

3 Steps for International Payments Expansion with Citcon

Citcon enables international eCommerce expansion while minimizing the risks, expenses, and complexity of accepting international payment methods. Here’s how it works:

Step 1. Connect

There is no setup fee and integration takes only minutes (build onto your existing systems with a simply-coded API). Merchants can tap into the buying power of 2 billion mobile wallet users around the globe, all while providing granularity and flexibility to control the customer checkout experience.

Step 2. Integrate

There is no need to work with different payment providers. Usually, a single payment integration takes three months, but with Citcon, it takes one week to two months, empowering merchants to get up and running faster. Once integrated, one switch is all it takes to turn on additional payment methods.

Citcon’s payment infrastructure covers Visa and MasterCard and over 100 local payment schemes for Asia Pacific, North America, and other global regions in a single integration. There’s one reconciliation as well as promotional capabilities and self-service reporting. It truly is an all-in-one payments solution.

Step 3. Enable

Citcon’s automated risk management approach uses technologies — such as IP intelligence, device profiling, and cyber threats detection — to identify fraud and decrease cyberattacks. Citcon’s systems examine transaction risk attributes such as transaction amounts, payment patterns, locations, and devices that prevent and block potentially fraudulent behavior, so merchants can feel confident that data is secure and fraud is less likely.

Citcon uses an AWS Cloud-based platform, making it highly reliable, with a 99.9% uptime rate. This helps keep merchants’ mission-critical revenue drivers (such as eCommerce payment gateway services) running smoothly. Citcon’s iOS and Android mobile software development kits (SDKs) provide the tools needed to integrate payment solutions into merchant applications in a transparent, customer-friendly way. If help is needed, 24/7 merchant services are available with coverage around the globe.

Citcon provides a seamless solution for North American merchants to accept traditional and alternative payment methods internationally in one integrated platform. Connect with a Citcon payments professional today to get started.