QR Code Payment: USA Popularity

Quick-response codes are catching fire in the United States. While they’re already well-established in Asia, QR code payments in the USA are fast becoming a favorite of consumers and merchants alike.

In our post-pandemic world, QR codes have become the gateway to reading restaurant menus, pushing nonprofit donations, transferring money, fueling marketing campaigns, and of course, completing payments for retailers. As the QR code conflagration grows, its diverse list of societal applications only continues to expand.

To truly grasp the rise of QR codes in the United States, however, it’s important to understand their origins and popularity overseas. History often repeats itself, and technological trends must be carefully observed.

For payments professionals and merchants, the question remains: will Asian demand for QR codes be replicated here in America? If so, when will QR codes become a true fixture of our economy?

While only time will tell, this article aims to review international trends to understand and predict the growing enthusiasm for QR codes here in the United States.

Read on for an overview of quick-response codes and how American merchants stand to benefit from their adoption.

The Origins of QR Codes

Once upon a time, the barcode was touted as the most advanced representation of data.

Originally theorized in 1932, the first barcode was scanned in 1974 on a pack of Wrigley’s chewing gum. Over the following decades, barcodes played an integral role in tracking data across every major industry.

Despite their innovation, however, barcodes ultimately proved to have limited potential. Because they can only be read vertically — from top to bottom — they can only store a finite amount of information.

Twenty years after the first barcode scan, the second generation of machine-readable optical labels was born. In 1994, the Japanese manufacturing company Denso Wave — a subsidiary of Toyota — created an advanced barcode that could be read both vertically and horizontally. This effectively evolved the two-dimensional barcode into a three-dimensional tool.

As a result, QR codes were born with the potential to house far more data than their one-dimensional predecessors.

While Denso Wave’s innovation launched nearly 30 years ago, it took almost a decade to gain a foothold in the international marketplace. That all changed in 2002, when Japanese mobile phones were manufactured to feature built-in QR readers. This seemingly simple step allowed QR codes to become ubiquitous, practically overnight.

Before long, the popularity of QR codes swept across every corner of Asia. Then, the unthinkable happened. In 2020, the pandemic ushered in a brave new world of masks, social distancing, and hand-sanitizing stations.

QR codes met the moment with a touchless and safe way to do anything from shopping to handling healthcare needs. At the crossroads of convenience and cleanliness, QR codes became a permanent fixture of the payments landscape.

QR Code Usage Statistics

In China, QR codes are the definitive payment method — and they have been for quite some time.

According to the Brookings Institute “China is leading the new revolution in digital payments. In the past decade, China has leapfrogged magnetic cards, moving to a system based on smartphones and QR codes.”

Most mentions of technological “revolution” seem hyperbolic. In this case, it’s nearly an understatement.

In fact, Chinese mobile payments amounted to nearly $30 trillion (196.98 trillion RMB) in 2020 alone. The vast majority of these payments were completed through Alipay and WeChat Pay, platforms that both tout over one billion monthly users.

Over 40% of all worldwide QR code coupon redemption originates in Asia alone, and 50% of all Chinese citizens scan QR codes multiple times a week.

While these numbers are stunning, it’s the trend that’s even more tantalizing. After all, China’s QR-driven mobile payments in 2020 were up nearly 19% over the previous year.

While scan-to-pay transactions in China have grown fifteen-fold since 2017, other countries in the region are contributing to its popularity.

In India, 40% of the population use QR codes, and over 27% of Vietnamese communities do the same. The trend is truly contagious throughout Singapore, the Philippines, South Korea, and beyond.

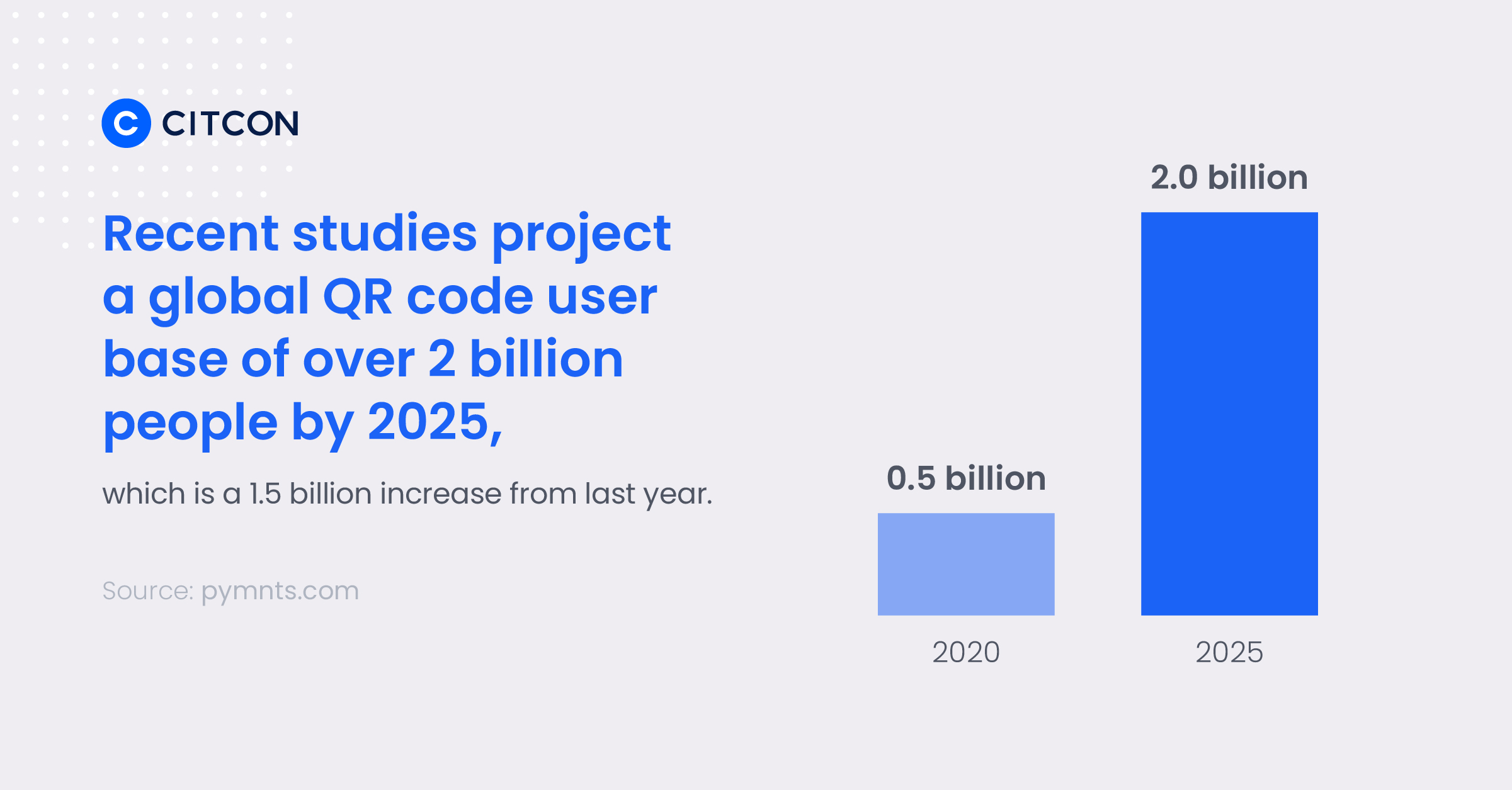

Mobile payment mania appears to have no end in sight. In fact, recent studies project a global QR code user base of over two billion people by 2025. By that time, QR code payments will have a total annual value in excess of $2.7 trillion.

Such popularity will likely be attributed to one major factor: the growing adoption of QR codes in North America.

The Rise of QR Codes in America — Usage Statistics

Though QR-codes are designed for quick response, their uptake in the United States has been relatively slow (at least when compared to Asia).

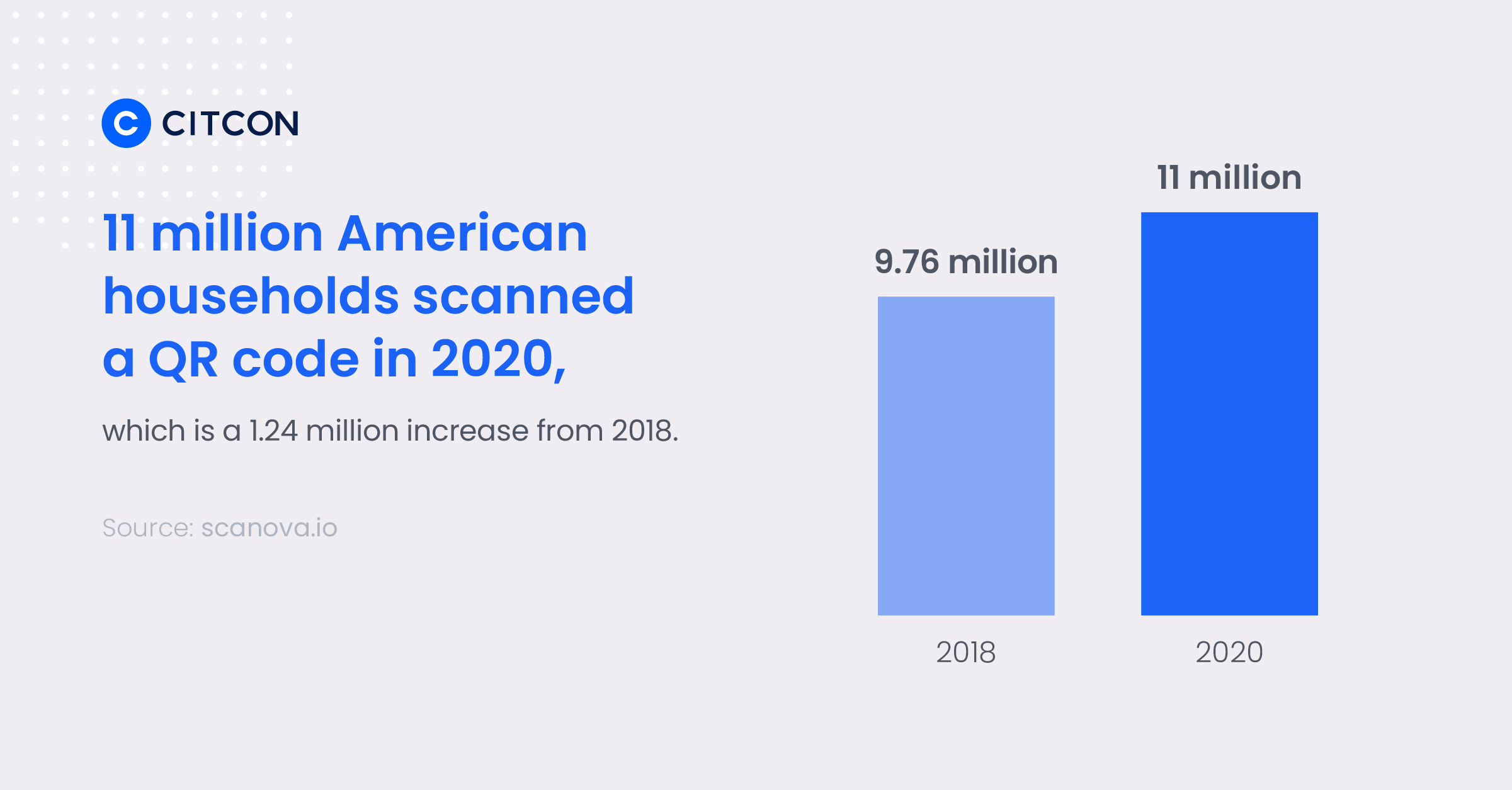

In 2020, for example, 11 million American households scanned a QR code. While that’s an increase from the 9.76 million scans in 2018 (and certainly an improvement on the 6.2% who scanned codes back in 2011), it’s considerably less dynamic than many forecasters predicted.

So why has QR code adoption in America lagged behind other parts of the world? There are several potential causes to consider.

On the one hand, QR code scanners weren’t built into most smartphones until 2017, when Apple finally included them in iOS 11. By this time, the tech giant was nearly fifteen years behind the Japanese, who started integrating QR codes into mobile phones way back in 2002.

Secondly, near-field communication (NFC) technology payments are a more popular (and trusted) form of contactless payments in North America. As a result, QR codes have had a difficult time staking new territory in the market.

Old habits die hard. Whereas China has been effectively cashless for years, American consumers haven’t embraced payment innovations with quite the same level of fervor.

Still, pandemic-inspired habits and trends suggest that QR codes will play an increasingly vital role in the future of American payments.

QR Codes: Key Benefits for Merchants

While more and more consumers are steadily embracing QR codes, merchants remain fully invested in their success.

After all, they stand to enjoy a number of benefits, including:

• Reduced operational costs, as merchants will need fewer point-of-sale (POS) terminals (and potentially fewer staff)

• Greater convenience, as a QR-based payment system can be enabled with just one smartphone

• Increased accessibility, as the vast majority of Americans have smartphones with built-in QR code scanners

• Improved safety, as QR codes promote a touchless buying experience for consumers

• Strengthened security, as QR codes provide unprecedented levels of encryption

• Enhanced speed, as QR code payments rank among the fastest alternative payments

For modern merchants, there’s truly unlimited upside potential in adopting QR codes. Conversely, merchants that neglect to include QR codes in their payment suite may face significant financial loss.

As Citcon CEO Chuck Huang recently noted,

“[Merchants that] don’t include the use of online QR codes outside of the U.S., if they go to Asian or Chinese consumers without offering the QR code, they lose 80% of their audience. Even for the U.S., if a younger consumer has a QR code option to pay before they go pick up food at a restaurant, they’re going to use it.”

Change is coming. The question remains: will merchants be prepared for the inevitable shift?

Moving Forward

It’s only a matter of time before quick-response codes become commonplace in the United States. Indeed, there are simply too many smartphones and digital wallets in circulation to stop the coming QR code revolution.

That’s why American merchants are preparing for the alternative payments of tomorrow by integrating QR codes into their businesses today.

At Citcon, we’re dedicated to helping business owners elevate their customer experience across every touchpoint. By leveraging our advanced API, you can give consumers the convenient, accessible, and safe payment options they know and love.

Ready to learn more about the power of QR codes?

Click here to request a short, no-commitment demo with a member of the Citcon team today.